Should you keep savings in cash or invest?

AN ORIGINAL ARTICLE FROM SQUARE MILE INVESTMENT SERVICES

To help clients with this tricky issue, we have looked to outline the advantages of both saving

cash and investing.

Advantages of holding cash

- Cash is now offering 4% interest, which is an attractive return and will not lose value in nominal terms.

- Cash rates will/should increase as interest rates rise, although this will likely not applyto fixed-term accounts.

- If inflation proves stubborn and interest rates need to move higher or stay high for a while, then cash rates should benefit from this.

- If inflation falls below cash rates, then investors will make gains in real terms.

- Cash can help shelter portfolios from short-term market volatility.

Disadvantages of holding cash

-

- Cash rates will decrease as interest rates fall, reducing returns; and providers will likely be very fast to cut rates on products as interest rates come down.

- Yields on bonds are always typically higher than those from cash. The UK 10-year government bond is currently yielding 4.5% and corporate bond markets (debt issued by companies rather than governments) even more than this; closer to 6% for the UK corporate bond market.

- Bond yields will likely fall as interest rates drop and this should increase bond prices therefore adding capital growth. For example, a 1% fall in yields should lead to a capital gain of c.10% for a 10-year bond.

- Cash must be held on account or invested in a money market fund for the whole year to capture the full rate.

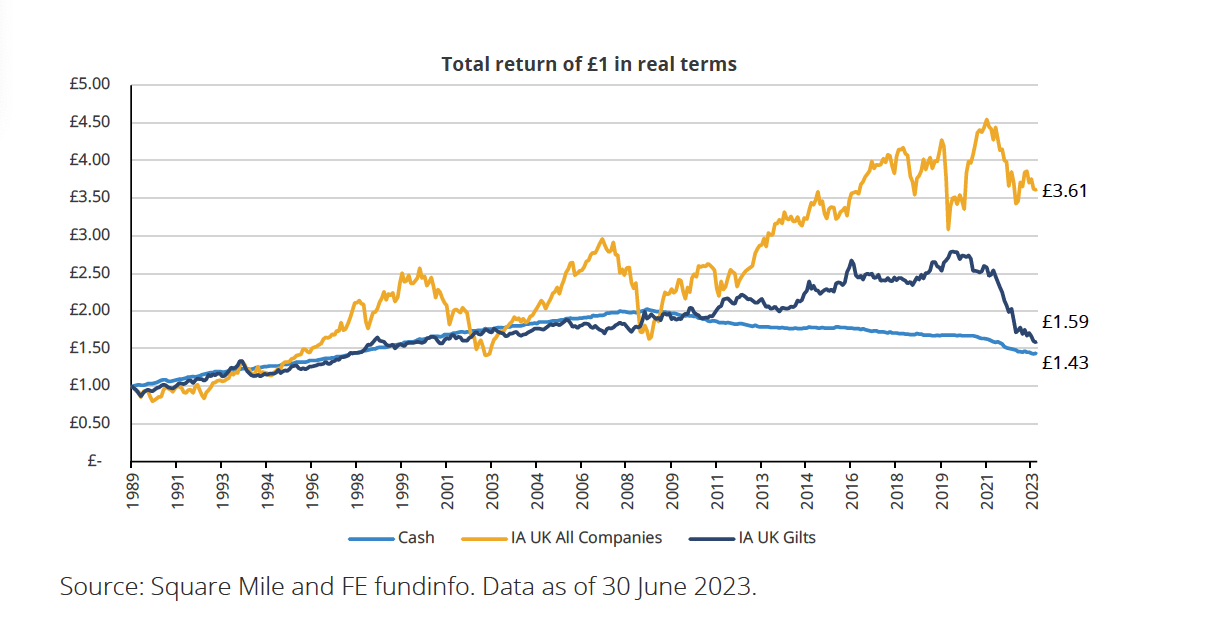

- Investing in cash will reduce/remove the participation in any continued market recovery, in bonds or equities. These asset classes have proved to deliver returns ahead of cash rates over the long term.

- Being out of the market, both bonds and equities, on days when they move up very sharply dramatically reduces the long term returns for portfolios, i.e., consistentl timing the market correctly is impossible. These days often happen when markets are volatile and performing at their worst.

-

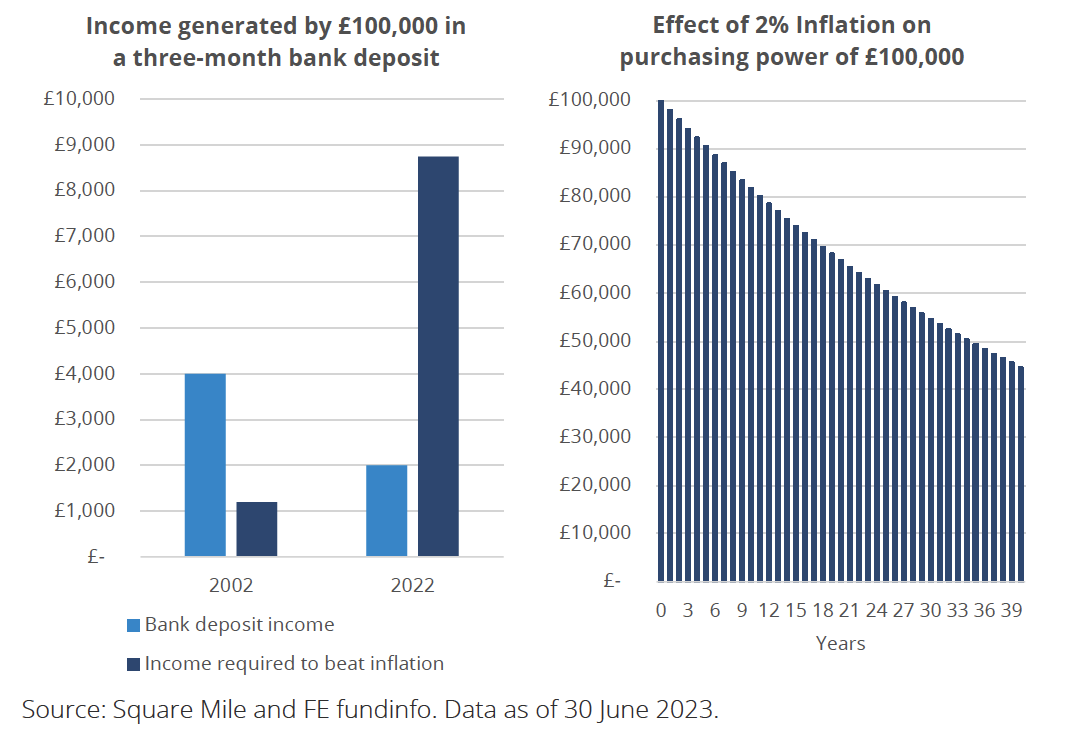

- For cash rates to outpace inflation, the rate paid needs to be higher than the inflation level. This is currently not the case with inflation at 8.7% in the UK.

- Falling inflation, which is expected despite recent figures, will reduce the need for high interest rates, and will therefore lower cash rates as they fall.

- Higher interest rates increase the chances of a recession and destabilising the housing market, which would increase the likelihood for interest rate cuts and therefore lower cash rates.

- Some accounts only allow a limited amount to be invested each month, up to a maximum level for the year. This means in the first year you will not receive the cash rate on the full amount allowed, but only on the amount that is invested each month.This rate will likely be reduced if rates fall.

- Inflation diminishes the value of your money in real terms.

In summary – should you save or invest?

While saving some money in cash makes sense for short-term goals, investing in the markets could serve you better over the longer term.

With all of the negative news at the moment, it’s perfectly understandable that investors see advantages in keeping more of their wealth in cash. Nevertheless, history shows that markets will bounce back from periods of doom and gloom and can be an effective way of making your savings grow in real terms, ahead of inflation.

Information Provided by The Investment Management Team, Square Mile Investment Services

July 2023 ,

- IMPORTANT INFORMATION

Our thoughts expressed in this report relate only to the portfolios we manage or advise on behalf of our clients and as such may not be relevant to portfolios managed by other parties.

Unless otherwise agreed by Square Mile, this report is only for internal use by the permitted recipients and shall not be published or provided to any third parties. This report is only aimed at professional advisers and regulated firms only andshould not be passed on to or relied upon by any other persons. It is not intended for retail investors, who should obtain professional or specialist advice before taking, or refraining from, any action on the basis of this report, remembering past performance is not an indication of future performance. Square Mile Investment Services Limited (“SMIS”) makes no warranties or representations regarding the accuracy or completeness of the information contained herein. This information represents the views and forecasts of SMIS at the date of issue but may be subject to change without reference or notification to you.

SMIS does not offer investment advice or make recommendations regarding investments and nothing in this report shall be deemed to constitute financial or investment advice in any way and shall not constitute a regulated activity for the purposes of the Financial Services and Markets Act 2000. This report shall not constitute or be deemed to constitute an invitation or inducement to any person to engage in investment activity and is not a recommendation to buy or sell any funds or investments that are mentioned during this report. Should you undertake any investment activity based on information contained herein, you do so entirely at your own risk and SMIS shall have no liability whatsoever for any loss,damage, costs or expenses incurred or suffered by you as a result. SMIS does not accept any responsibility for errors,inaccuracies, omissions, or any inconsistencies herein.

Square Mile Investment Services Limited is registered in England and Wales (08743370) and is authorised and regulated by the Financial Conduct Authority (FRN: 625562).