Volatility in Equity Markets

Many of you will be aware of the volatility that stock markets have experienced throughout the coronavirus pandemic, with the FTSE 100 index trading at over 7,600 back in January 2020 and falling to a low point of 4,993.89 on 23 March 2020. This represents a fall of some 35% from peak to trough. However, the majority of investment funds we typically recommend fell by only a fraction of this amount during the turmoil. Whilst indices such as the FTSE 100, along with individual companies and industries such as air travel, will typically grab the headlines for their recent share price free fall, investment funds have seen the benefit of diversification and fund manager discretion in enabling them to limit their exposure to falling markets. Whilst funds have not been entirely immune from the recent volatility by any means, the performance of collective funds throughout this period has provided a reminder that diversification can limit downside risk.

At the time of writing, the FTSE 100 has risen above 6,000 and is closing in on 6,500, so markets overall have undoubtedly shown some recovery within a relatively short time frame. Such a bounce-back in performance illustrates the importance to investors of holding their nerve during a crisis and remaining invested in order to avoid missing out on such a recovery in the markets. We would urge investors not to make any spur of the moment decisions in the light of recent events and to remain patient regarding a recovery, with a long-term outlook being the key to successful investing, as history has shown us. The recovery since 23 March also shows that there remain attractive investment opportunities available for those looking to take advantage of these, and the investment outlook is far from the “doom and gloom” that some headlines may appear to indicate. We are not, however, expecting a “straight line recovery” and there will inevitably be further volatility in the future as is to be expected when investing in equities.

Whilst markets have not recouped all of the losses sustained since the start of the year, this is not necessarily the case for investment funds due to their internal diversification, fund manager discretion and stock selection processes. We are now seeing a number of funds at both ends of the risk spectrum that are showing positive performance figures over timescales of one, three and six months, having now recovered almost entirely to their pre-crisis unit prices.

At the higher-risk end, we have the example of Fundsmith Equity:

The above graph illustrates how the fund price has now recovered to (and slightly beyond) it’s pre-crisis levels and also emphasises the benefits of long-term investing due to the overall upward trend over five years.

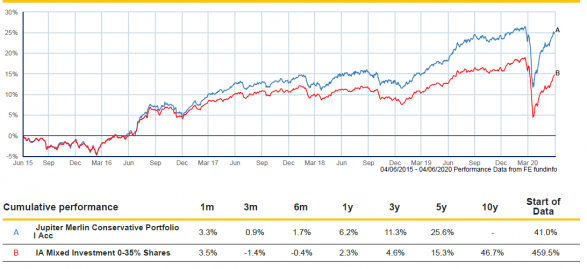

At the more conservative end of the risk spectrum, we have Jupiter Merlin Conservative:

Again, you can see that the fund price has returned almost to pre-crisis levels, with positive returns having been made over the last month, three months and six months, along with the more gradual upward trend over the full five-year period shown.

Such figures should be reassuring to investors during such a tumultuous and unprecedented time and will hopefully help to allay some of the fears and concerns they may have in relation to their finances as we move forwards. There remain positive indicators within global markets and there will undoubtedly remain some attractive investment opportunities in the future. As financial advisers, we are equipped with the tools to identify such opportunities and these volatile times may serve to further emphasise the value of advice.

Please note that neither of the funds mentioned above should be taken as a personal investment recommendation and these are merely included as examples to show the impact of Covid-19 and other economic factors on fund performance. Furthermore, past performance is not necessarily an accurate guide to future returns. Capital at risk.